25+ what is ltv in mortgages

Web In the context of buying a new home your LTV is the mortgage amount divided by the total value of the home. The mortgage would be 270000 resulting in an LTV ratio of 90.

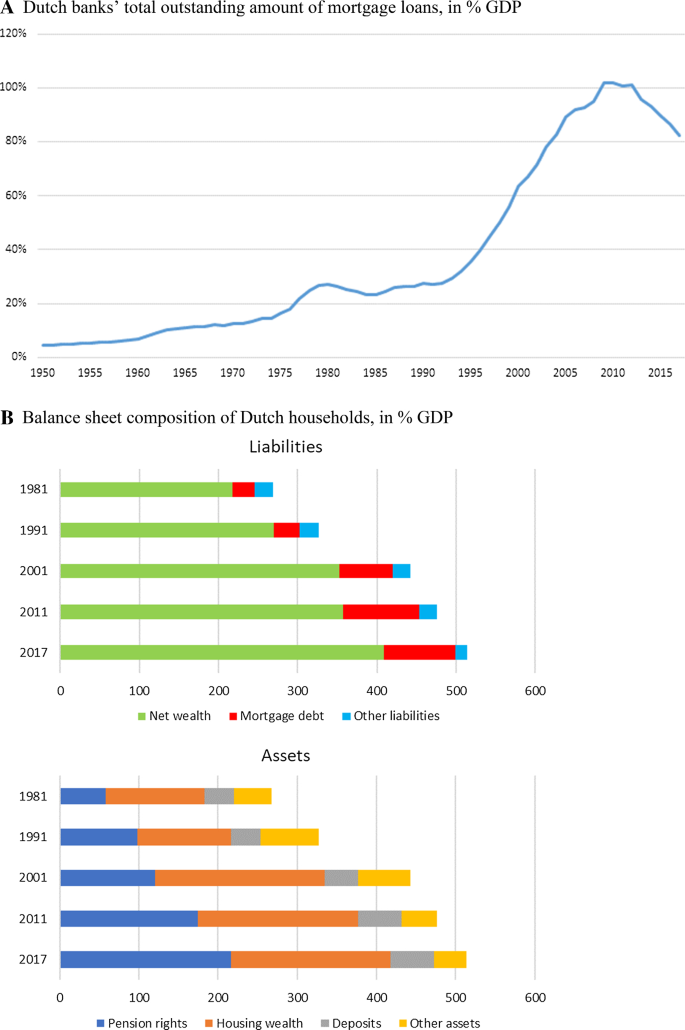

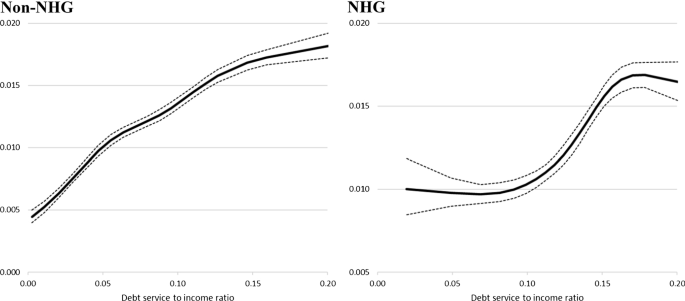

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

CLTV Loan-to-value LTV and CLTV are two of the most.

. This gives you an LTV of 80 so you should look for mortgage deals that are available up to. Lets say you want to buy a home that costs. Web You have your eye on a 300000 house and can afford to put 10 down or 30000.

Web LTV is an indicator of how much youre borrowing relative to the value of the asset. Web What Is LTV. For example if you are buying a.

Web Loan-to-Value - LTV Calculator Loan-To-Value Calculator Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far. Web To find out your LTV simply divide 200000 by 250000 and then multiply by 100. If your home is worth.

Find A Lender That Offers Great Service. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. With a 90 LTV mortgage you borrow 90 of the cost of the home you want to buy and put down the remaining 10 as your deposit.

Web To calculate the LTV of a loan you need only the loan amount and the homes value. Web Your combined loan-to-value ratio CLTV is 75. It Only Takes Minutes to See What You Qualify For.

Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The two-year products with competitive interest rates are available at 65 to 75 loan-to-value LTV.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. A loan-to-value LTV ratio is the relative difference between the loan amount and the current market value of a home which helps lenders assess risk. To calculate loan to value divide your mortgage.

Your loan to value ratio LTV compares the size of your mortgage loan to the value of the home. Web The LTV short for loan-to-value ratio is the ratio of the mortgage balance to the value of the property. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web What Is A 90 Percent Mortgage. Web The remainder 180000 is your mortgage. Save Real Money Today.

Web Loan to value which is often shortened to and displayed as LTV by mortgage lenders is simply the percentage of the cost of the property you are borrowing. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. 100000 50000 200000.

You take the loan amount and divide it by the homes value. The higher the ratio is the more risk the lender is taking on by lending you money. Web To calculate your LTV ratio divide your mortgage amount by the value of the property youre buying and multiply the figure by 100.

Compare More Than Just Rates. Web 2 hours agoLeeds Building Society has launched two fixed-rate mortgages. For example if you borrow.

To calculate the LTV ratio youd divide the mortgage by the value of the home so the LTV formula would be. Web What does LTV mean.

1st Florida Lending I No Doc Hard Money Loans

Time To Switch To A New Mortgage Rate Monevator

Marsden Launches Range Of Expat Mortgages Through Packager Mortgage Solutions

Galina Tatulyan Option 1 Mortgage Llc Farmington Hills Mi

Jon Chamberlain President Security Home Mortgage Linkedin

Ex 99 1

Ltv Meaning Moneysupermarket

What Does Loan To Value Ltv Mean How To Calculate Ltv

1st Florida Lending I No Doc Hard Money Loans

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

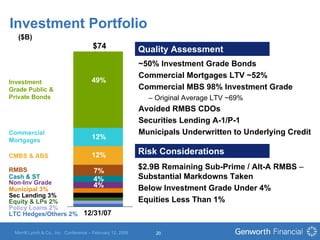

Gnw 02 12 08 Merrill

Loan To Value Ratio Prepnuggets

How Much Can You Borrow With A Reverse Mortgage Ratespy Com

Jonathan Driver Mba Sales Manager Zeuslending Com Linkedin

Ltv Loan To Value Mortgages Explained John Charcol John Charcol

Investor Presentation

Real Estate Are High Loan To Value Ratios The Most Risky Banque De France